Crafting a Winning Business Proposal for Finance Approval

In the world of business finance, a well-written and carefully structured finance proposal can make all the difference between securing the funds you need and facing rejection. As a finance broker based in the UK, I’ve seen first-hand how critical a compelling proposal is in the approval process.

Every day, I help business owners draft and refine proposals that not only meet lender criteria but also showcase the true potential of their business.

In this article, I’ll share expert insights and practical tips for creating a finance proposal that maximises your chances of approval. Whether you’re seeking funds for expansion, new equipment, or to optimise cash flow, these principles will guide you towards success.

You can also watch my short video on my top tips here.

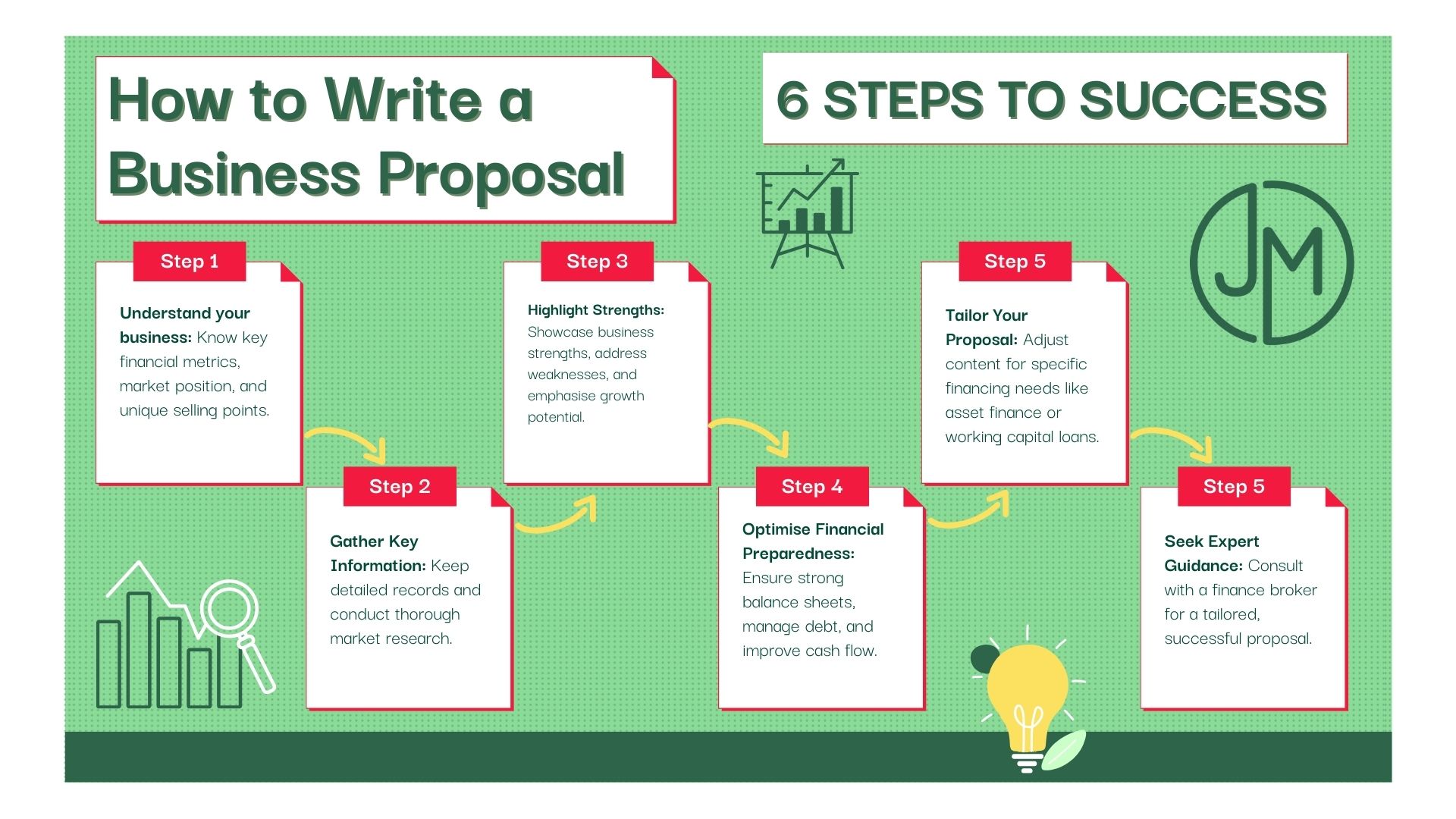

How to Write a Business Proposal: 6 Steps to Success

Follow these six steps to create a financial proposal that stands out to lenders:

-

Understand your business: Know key financial metrics, market position, and unique selling points. Gather Key Information: Keep detailed records and conduct thorough market research.

-

Highlight Strengths: Showcase business strengths, address weaknesses, and emphasise growth potential.

-

Optimise Financial Preparedness: Ensure strong balance sheets, manage debt, and improve cash flow.

-

Tailor Your Proposal: Adjust content for specific financing needs like asset finance or working capital loans.

-

Seek Expert Guidance: Consult with a finance broker for a tailored, successful proposal.

Understanding Your Business

Before approaching lenders, it’s crucial to have a deep understanding of your own business. This includes knowing your financial health, market position, and growth potential.

In this section, I'll delve into the importance of this understanding and provide practical tips for gathering and presenting this information effectively.

Understanding your business inside and out is fundamental when seeking financing. Lenders want to see that you have a clear grasp of your company's financial health, market position, and growth potential. Lenders want to see that you have a clear grasp of:

-

Financial Metrics: Know your turnover, profit margins, and acquisition costs. This demonstrates your financial viability and ability to repay the loan.

-

Market Analysis: Understand your target market, industry trends, and competitors. This shows lenders that you've done your homework and have a realistic understanding of your business environment.

-

Unique Selling Proposition (USP): Identify what sets your business apart from competitors. Highlighting your USP helps lenders understand your competitive advantage and market positioning.

-

Cash Flow Forecasts: Provide detailed cash flow projections to demonstrate how you plan to manage repayments and sustain operations.

-

Management Information: Include information about your management team's expertise and experience. Lenders want to see that you have a competent team driving the business forward.

Practical Tips for Gathering and Presenting Information

Practical Tips for Gathering and Presenting Information

-

Keep detailed records of your financial transactions, including income, expenses, and cash flow.

-

Use accounting software to generate accurate financial reports and forecasts.

-

Conduct thorough market research to identify opportunities and threats in your industry.

-

Clearly articulate your USP and how it addresses customer needs and preferences.

-

Provide evidence to support your claims, such as customer testimonials, market data, or industry reports.

Example: For instance, let's consider a small commercial contracting business experiencing rapid growth but facing cash flow challenges due to increased staffing needs and upfront project costs. With comprehensive financial data and market insights readily available, they can effectively articulate their financing needs to lenders.

In their proposal, they can highlight past successes, future revenue projections, and anticipated expenses, demonstrating the potential for continued growth. By presenting a clear plan for utilising a business loan or asset finance to support operations and drive expansion, this contracting business can acquire the necessary financing to overcome cash flow hurdles and capitalise on growth opportunities.

Presenting Your Business in the Best Light

To craft a compelling finance proposal, you must present your business in the best light. Here's how to do it effectively:

-

Highlight Strengths, Mitigate Weaknesses: Structuring your proposal to accentuate your business's strengths while addressing weaknesses is crucial. Showcase notable achievements, like successful projects or client endorsements, to establish credibility. Transparently acknowledge challenges and propose proactive solutions, such as implementing cost-saving measures or diversifying revenue streams.

-

Showcase Unique Value Proposition: Articulate your business's unique value proposition (UVP) to differentiate it from competitors. Highlight what makes your business special, whether it's your expertise, innovative solutions, or exceptional customer service. Use concrete examples and data to demonstrate how your UVP benefits clients, bolstering your proposal's persuasiveness.

-

Demonstrate Growth Potential: Demonstrate your business's growth potential by outlining future opportunities and expansion strategies. Discuss relevant market trends, emerging prospects, and plans for scaling operations. Incorporate financial forecasts and performance metrics to reinforce your growth narrative and inspire confidence in potential lenders.

-

Optimise Formatting and Language: Ensure your proposal is well-structured and easy to follow. Use clear headings, bullet points, and subheadings for logical organisation. Keep language concise and avoid overly technical terms that may confuse readers. Focus on communicating your message clearly and persuasively to resonate with business lenders in the UK.

Crafting an effective finance proposal for your business not only communicates your vision and goals clearly but also increases your chances of securing the necessary funding and support you require.

Financial Preparedness

To ensure your finance proposal stands out and instils confidence in lenders, consider these strategies to ensure you are as financially prepared as possible:

-

Optimise Your Balance Sheet and Financial Statements: Improve your balance sheet by cutting unnecessary debts, using assets efficiently, and reducing costs. A clear and accurate financial picture builds lender trust and increases your chances of getting funding.

-

Demonstrate Financial Stability, Liquidity, and Profitability: Highlight your business’s financial health. Provide proof of steady cash flow, strong liquidity, and long-term profitability. This reassures lenders that you can meet your financial commitments and repay loans..

-

Manage Debt Levels and Improve Creditworthiness: Keep your debt under control and work on improving your credit rating. Strategies like refinancing high-interest loans or negotiating better repayment terms can help. Also, maintain a good credit history by making payments on time and lowering your debt.

-

Maximise Available Resources: Make the most of your resources to strengthen your proposal. Look for ways to boost revenue, cut costs, and run operations more efficiently. Using your assets effectively shows you can handle growth and make the most of available resources.

-

Mitigate Bounced Payments and Cash Flow Challenges: Prevent bounced payments and manage your cash flow well. Use financial systems to track spending, forecast future needs, and manage expenses. Consider overdraft facilities or keeping a minimum balance to handle unexpected costs and avoid cash flow problems.

⚠️ Tip: Avoid bounced payments! I cannot stress this enough! Lenders now have software that detects poor payment history. Missing payments can make obtaining finance at a reasonable cost more difficult.

Tailoring the Proposal for Different Financing Needs

Crafting a finance proposal requires tailoring your approach to meet the specific financing needs of your business. Here's how to adapt your proposal depending on the type of finance being sought:

-

Understanding Different Financing Needs: Different types of financing require different approaches. Whether you're seeking asset finance, working capital loans, expansion funding, or other options, your proposal needs to address the specific requirements of each lender.

-

Examples of Proposal Variations: The content of your proposal will vary based on the type of finance you're applying for. For asset finance, focus on the assets you're purchasing (like equipment or machinery), including their value, depreciation, and expected return on investment. For working capital loans, highlight your cash flow projections, short-term funding needs, and repayment plan. If you're seeking expansion financing, include growth plans, market analysis, and projections for returns.

-

Aligning with Lender Requirements: Make sure your proposal matches the lender's preferences. Research each lender to understand their criteria and risk tolerance. Tailor your proposal to show how your business meets these criteria, particularly in terms of creditworthiness and repayment ability.

You can jumpstart your business finance proposal by using business plan and cash flow forecast templates to provide solid structure for your document.

Need help with your proposal?

Crafting a finance proposal can be complex, especially with multiple financing options to consider. From asset finance to working capital loans and expansion financing, it's clear there are many elements to juggle. This is where the guidance of an experienced finance broker becomes invaluable. This is where a trusted finance broker can be invaluable, helping you navigate the process with tailored advice every step of the way.

So, there you have it... Preparing a finance proposal tailored to your business's unique needs requires a nuanced understanding of the financial landscape. With many elements to consider, seeking the guidance of an experienced finance broker can make the process smoother and more successful.

At James Murray Finance, we offer personalised and consultative services with a no-pressure approach. Trusted by business owners across the UK, we provide expert guidance to help you navigate the complexities of finance.

I hope you've found this latest article useful and thanks for reading and if you'd like to see me talk about similar topics in more detail, and in particular, how long it takes to get approved for finance, check out my short video HERE

James

🗺️ Located in Stamford, Lincolnshire, 20 minutes from Peterborough, Cambridgeshire, we're conveniently situated to serve businesses nationwide. Contact us today to discover how we can assist you in securing the right financing solution for your business.

Don't miss out on valuable insights and updates! Subscribe to the blog via LinkedIn HERE or follow on social media to stay informed about the latest trends and developments in the world of finance and business.

(All links can be found at the bottom of this page)

Disclaimer: This blog post is intended for informational purposes only and does not constitute financial advice. All information is collated at time of writing and the best efforts have been made to ensure accuracy.